- Working strategy for binary options «Ambit»

- Tools of the «Ambit» system

- Trading signals

- Expiration

- Money management

- Strategy Oil: Trading on the news binary options for profit

- Trading binary options on the news

- Terms of the Oil Strategy for Binary Options

- Trade expiration time and risk management

- An accurate and simple strategy for binary options «Constrictor»

- Services of the «Constrictor» system

- Constrictor system — signals

- Expiration

- Money management

- How to make money on binary options without risk: Ladder strategy

- The essence of the trading system

- Optimizing the Ladder strategy

- Strategy of binary options for beginners «Bloom»

- Setting up a template

- Rules for purchasing contracts «Higher / Lower»

- Choosing expiration

Collected profitable and high-quality strategies for trading binary options. All strategies have been tested on real accounts, I recommend trying them on demo as well.

Working strategy for binary options «Ambit»

Working strategy for binary options Ambit, the strategy in which is applied, a combined technique of determining market directions for high earnings on trades. To receive technical signals for trading binary options, market investors need a strategy capable of determining the most favorable conditions for opening positions on the basis of special services. As a good example of an effective and versatile system, we suggest a technique.

Tools of the «Ambit» system

The following set of services is used as a means of determining the levels and the most favorable moments for the execution of contracts in the Working strategy for binary options «Ambit» system:

Fibonacci levels are price quotation levels calculated according to a special algorithm, at which the market trend reverses or strengthens the impulse movement. Using this service, you get extremely important technical information necessary to open a profitable position.

- EMA indicators — here you will need 2 services with a market assessment frequency of 5 and 10. These technical tools will work as a tool for determining narrow-range technical reversals of quotes from Fibonacci levels. Thus, we receive an additional signal of a trend reversal, thereby increasing the technical indicators of the effectiveness of strategy forecasts.

- The MACD indicator — we use this market assessment resource in standard settings and in the classic format — a filter of technical signals of the main components of the strategy.

Trading signals

When registering CALL contracts, use the following set of system service indicators:

- As a result of fluctuations, the price reached one of the significant Fibonacci levels, after which it rebounded

- The trend lines of the EMA indicators made an upward intersection between them near the touch zone of the Fibonacci levels

- On the filtering oscillator, the lines show a clear divergence upward

When registering PUT contracts, use the following set of indicators of the system services:

- As a result of fluctuations, the price reached one of the significant Fibonacci levels, after which it rebounded

- The trend lines of the EMA indicators made a downward intersection between them not far from the touch zone of the Fibonacci levels

- On the filtering oscillator, the lines show a clear divergence downward

Expiration

The choice of the period for repayment of trading rates is carried out taking into account the timeframe of the estimated chart and the general indicator of the volatility of the financial instrument. The highest indicators of trading profitability were obtained when evaluating the minute chart and using contracts with an expiration of 5 minutes.

Money management

The system provides a relatively safe trading format when working on the market with the minimum available rates. If the investor’s capital allows, then risks can be set at a maximum level of 5% of the capital amount. Under these conditions, possible financial losses will not have a critical impact on investment capital.

Strategy Oil: Trading on the news binary options for profit

How to trade and make money trading oil through binary options is profitable. Consider a strategy for trading OIL (Oil). How do you know where the quotes will be directed in the near future? Which order (PUT or CALL) should be opened for the trader to make a profit.

Trading binary options on the news

First, a few basics. This or that state publishes statistical data in the macroeconomic calendar every day. It also contains the release time of the report and forecast data. You can find such a calendar on most thematic Internet resources. For our part, we advise you to follow the news of the world powers on the Investing.com website. There it is published online on time.

Terms of the Oil Strategy for Binary Options

An important feature of this trading tactic is that oil quotes are more prone to price spikes in the course of news publications than it happens in the Forex market. Therefore, we can assume that a trader who trades with an OIL asset has an increased chance of earning income from trading.

Note that news affecting oil is published on Wednesdays and Fridays. To be precise:

- Statistics for 7-day crude oil inventories are published at 00:35 Moscow time on Wednesdays.

- The crude oil storage reports can be expected on Wednesdays at 6:30 pm Moscow time.

- The number of Baker Hughes wells can be expected on Fridays at 21:00 GMT.

So what does it take for news traders to profit from OIL price swings? Just follow the step by step guide:

- We open the calendar of economic publications a few minutes before the official release of reports affecting the oil rate.

- Not far from the calendar, a trading platform of your binary options broker should be open.

- As soon as the news is published, you need to decide on the direction of the transaction for the OIL asset.

- We are waiting for the publication of news on weekly crude oil residues (Wednesday at 00:35 Moscow time):

- if the numbers turned out to be less than the forecasted ones, then the deal is on CALL (“Up”);

- if the numbers turned out to be higher than the forecasted ones, then you should open a deal on PUT (“Below”).

- When publishing news about crude oil reserves in oil storage tanks (released on Wednesday at 18:30 Moscow time):

- if the reported data is lower than the forecast — CALL;

- if the reported data is higher than the forecast — PUT.

- Upon release of the news on the number of operating rigs by Baker Hughes (published on Fridays at 21:00 Moscow time):

- if the reported data exceed the forecast — PUT;

- if the reported data is lower than the forecast — CALL.

- An important point of trading with this TS is that if it coincides with the forecast data, the trader should refrain from opening positions.

- If there is a discrepancy between the report and the forecast, the trader must immediately conclude a deal in the appropriate direction.

According to the strategy for BO Neft, only three deals per week will be issued per week. However, they will give the player 100% profit. Just for the sake of this, it is worth trying BO trading on the OIL asset.

Trade expiration time and risk management

The best expiration time for the «Oil» tactic for binary options is considered to be 60 minutes. This time should be enough for the asset to travel far. It is important to properly manage your capital. The success of trading also depends on this. Use in each transaction no more than 5% of the total balance of the trading account. To trade without fear of losing your deposit, the optimal amount of the initial deposit will be $ 50.

An accurate and simple strategy for binary options «Constrictor»

An accurate and simple strategy for binary options Constrictor — is able to generate up to 15 forecasts for opening positions in the options market within an hour, of which up to 90% will be successful. The system is easy to use, works with standard tools and is accessible even for beginners.

Services of the «Constrictor» system

The technique for determining profitable price levels for opening options using a simple strategy for binary options «Constrictor» is based on the systematic use of a combination of the following analysis services:

- A set of EMA indicators with technical periods of service lines 3/6/9/12/15. With the help of such a variety of periods of technical means for determining the trend, we expand the range of assessed market indicators, which allows us to determine market movements, both in a narrow and relatively wide mode. Together, we get a system of tools for generating highly accurate trading signals.

- Bollinger Bands indicator — to build a price channel, set the period of 50 and deviation 3. The specified settings of the technical analysis resource makes it possible to determine medium-term trend reversals of quotes — this improves the quality of the generated forecasts of the system

- MACD indicator — in this case, we leave the oscillator settings as standard. This service is required to confirm the indicators of the system of the main strategy tools. By filtering the system signals using this tool, we get the maximum trading efficiency.

We recommend the 30-second timeframe as the most optimal market assessment period in terms of performance — this technical indicator, among other things, makes it possible to obtain high trading dynamics:

Please note that the system uses a fairly standard set of technical analysis resources, which makes the strategy universal for use on any professional platform for trading in the options market.

Constrictor system — signals

Call — options are issued on the market when determining such a set of indicators:

- A set of technical movings of trend EMAs crossed upward the level of the median of Bollinger Bands

- MACD with its oscillator movings crossed the technical level of its own scale upwards

PUT — we issue options on the market when determining such a set of indicators:

- A set of technical movings in trend EMAs crossed down the median level of Bollinger Bands

- MACD with its oscillatory movings crossed the technical level of its own scale downwards

Expiration

To achieve the highest performance indicators of the Constrictor system, use contracts with an expiration range of 5-10 minutes in options trading. In this mode, the strategy demonstrates excellent dynamics of trading operations and the maximum level of efficiency in processing technical forecasts.

Money management

Risk management, despite the high rate of forecast accuracy when using the system, is extremely important. In order to achieve the most acceptable conditions for the trading system, it is necessary to limit the maximum value of options to 5% of the investor’s operating capital. If the funds on the account are insufficient for trading in the specified mode, use contracts with the minimum value.

How to make money on binary options without risk: Ladder strategy

The ladder strategy is a simple strategy for binary options without risk, or to be precise, to minimize these very risks. If you do not violate its rules, the speculator is able to increase the size of his depot daily.

Below we will give you a profitable “Ladder” trading strategy for binary options without risk . We emphasize that it will not be used at all without risk. It will be present as a factor of surprise. After all, many factors influence the currency. But most of them are predictable, perhaps thereby reducing that percentage of surprise.

The essence of the trading system

The most important thing is to ignore flat price areas. After all, the essence of this trading strategy is reduced to the conclusion of transactions towards the closing of the signal candle.

There are various subspecies of the Ladder TS. We will tell you about the most profitable version in our opinion. In the case when we observe the closing of the current candlestick for a fall, and the next candlestick pierced its minimum at the price, in this case it is recommended to immediately open a PUT (“Down”) deal. The expiration time is 5 minutes or one temporary candle with the used M5 timeframe. If there is a closing of a bullish (growing) candle, then we watch the next candle. In the event that it breaks the high of the previous candle, you can buy a CALL (“Higher”) contract.

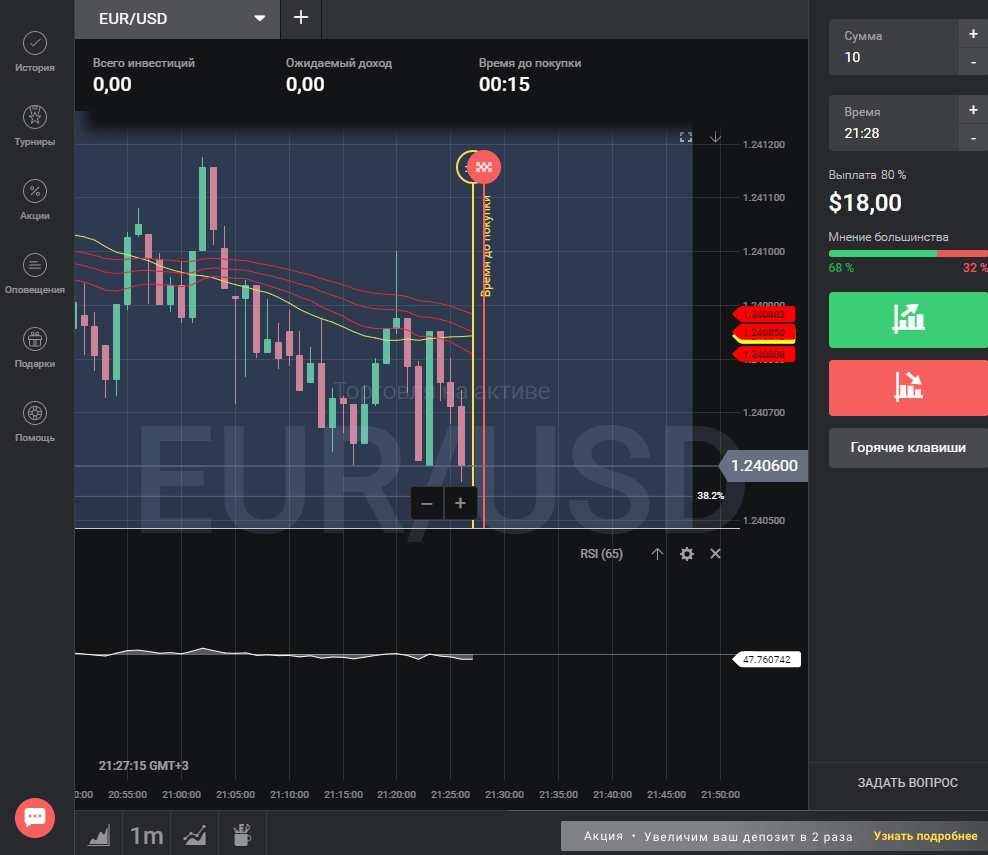

In the trading platform, it looks like this:

Note that we did not have time to conclude the deal «Above» in time. Nevertheless, the contract turned out to be a winning one.

Optimizing the Ladder strategy

It is clear that unprofitable contracts will arise. This is experienced by absolutely any binary speculator. This particular strategy of binary options without risk is afraid of flat areas. They can be tracked by means of certain indicators. Therefore, we advise you to install MACD with standard settings. When the lines are very close to zero, refrain from trading.

This TS will work perfectly on any highly volatile currency pairs, including the CRYPTO IDX asset. Trading time: from 10:00 to 20:00 from Monday to Friday.

Above, we tried to explain how to make money on binary options without risk using the Ladder strategy? In the framework of a real account, this is unrealistic. However, if the rules of money management and the step-by-step instructions mentioned above are used correctly, you can make big money on BO using the “Ladder” strategy.

The main rule: don’t be greedy! Decide for yourself: how many profitable contracts you will conclude per day. We recommend no more than 5 pieces. Try to analyze the market using trading signals of summary technical analysis on the Investing service. Track only important signals (“Actively sell / buy”) on at least three time charts, and make deals only in their direction.

Strategy of binary options for beginners «Bloom»

This strategy is suitable for any currency pair, and even a beginner can master its basics.

The main instrument of this TS is two indicators: RSI and Moving Average. These indicators are among the best for technical analysis. Moving is a trendy turkey. So it can be used to determine the direction of the market, but here it will be used in conjunction with other moving averages.

The RSI indicator, which works in advance, in this trading tactic will be used as a filter for signals from MA. Thus, we will see extremely profitable areas for entering a trade.

Setting up a template

We select a financial asset that has a clear trend. Then we plot the following indicators on the chart:

- RSI (65) with trend levels 50/50.

- MA of the Simple type (60), you can set it to yellow.

- MA as Welles Wilder (40, 30 and 20). Let all three movings be red.

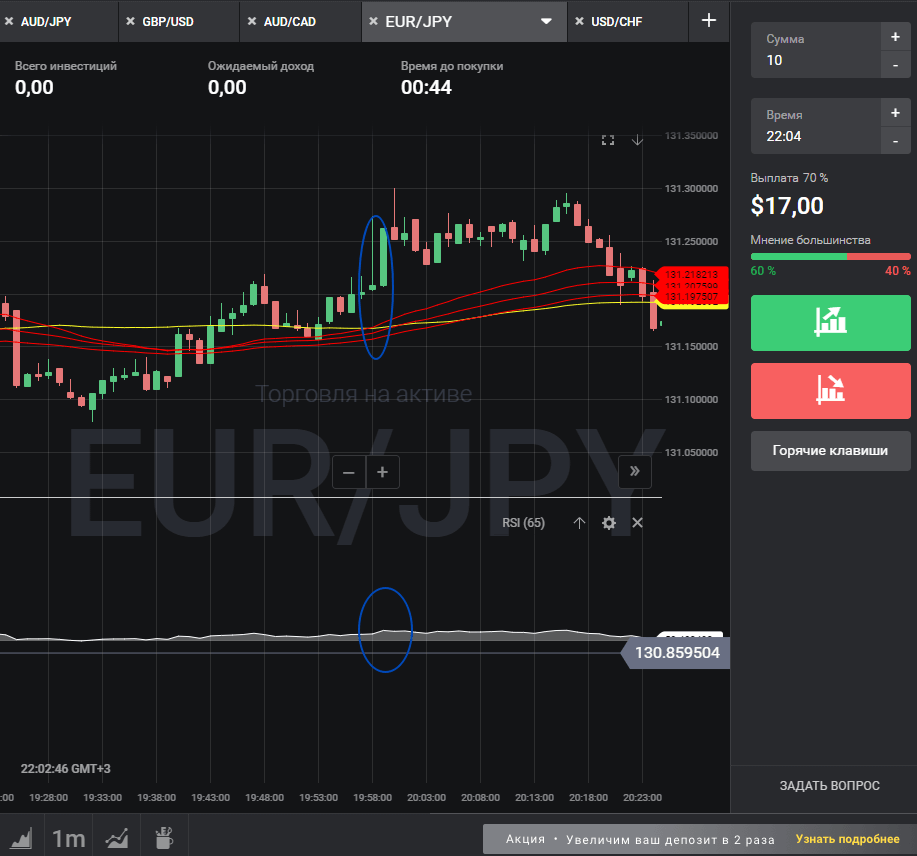

Trading can be carried out on any timeframe, but for convenience, we choose a minute interval. So, the established set of indicators within the strategy for options for beginners will look like this:

Rules for purchasing contracts «Higher / Lower»

It is easy to conclude deals using this trading strategy. It should be remembered that the signals for this will be the moment when three red MAs (Welles Wilder) show the intersection of the yellow MA. Then you need to filter this signal using the RSI indicator. Its line must break through the middle meridian (50) from bottom to top or top to bottom, depending on the signal.

Example of a «Up» transaction

A trader has the right to open a deal “up” if the following situation develops on the price chart:

- three red Welles Wilder movings crossed the yellow SMA from bottom to top;

- the RSI oscillator shows values above the 50th level (this signal may appear before the MA, since the RSI is good because it works ahead of time).

So, the signals to open positions Above will look like this:

Example of a «Down» transaction

In order for a trader to be able to open a trade “down”, the following picture should be displayed on his chart:

- three red Welles Wilder movings crossed the yellow SMA from top to bottom;

- the RSI oscillator shows values below the 50th level (this signal may appear before the MA, since the RSI is good because it shows signals before movings).

Note that on the one-minute chart, this strategy generates enough signals for novice options traders to open trades. And if you monitor 10-20 currency pairs, then you can dynamically increase your deposit.

Choosing expiration

If you analyze the price within the M1 chart, then the trade expiry time will be in 5 minutes. If you switch the timeframe, then you need to calculate the expiration separately. For example, trading on a 15s timeframe, a suitable expiry date would be 3 minutes.

But we forget about the golden rule: the older the timeframe, the more accurate the signals from the indicators .